Introduction

India is undergoing a remarkable transformation and energy diversification in its energy sector. With rising fuel demand, volatile crude oil prices, and global pressure to reduce carbon emissions, the country has put biofuels and energy diversification at the heart of its long-term strategy. From ethanol blending in petrol to biodiesel production, these policies are reshaping not only the fuels market but also allied industries—including the lubricant sector.

For lubricant makers, this transition presents both challenges and opportunities. As traditional petroleum-based energy sources give way to renewable and bio-based alternatives, lubricants must evolve to meet new performance standards, environmental regulations, and sustainability goals.

India’s Biofuels and Energy Diversification Strategy

India has set ambitious goals for its biofuel adoption and overall energy diversification:

Ethanol Blending: The government has targeted 20% ethanol blending in petrol by 2025, an initiative expected to save around US$4 billion annually in crude oil imports. Ethanol derived from sugarcane, rice, wheat, and corn is being integrated rapidly into India’s fuel mix.

Biodiesel Push: Under the National Biodiesel Mission, India aims to replace up to 20% of diesel with biodiesel. Feedstocks such as jatropha and used cooking oil are being explored, although adoption has been slower than ethanol.

Financial Incentives: The government provides subsidies, financial support, and tax reliefs to encourage private investment in ethanol and biodiesel production.

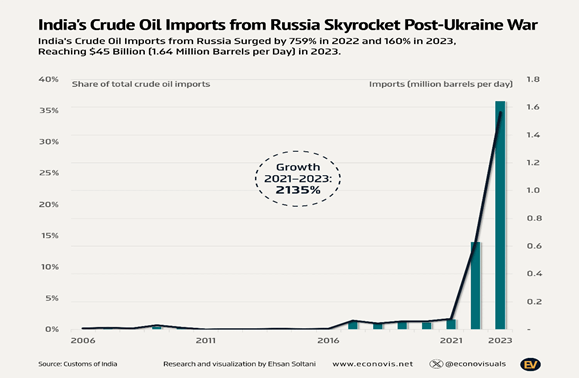

Energy Diversification: Beyond biofuels, India is promoting solar, wind, hydrogen, and natural gas as part of its strategy to reduce dependence on imported crude oil.

Together, these measures are laying the foundation for a cleaner, more self-reliant energy ecosystem.

Impact on Energy and Oil Demand

India’s energy demand is rising sharply due to industrial growth, urbanization, and infrastructure expansion. However, biofuel adoption directly affects fossil fuel consumption and crude oil imports.

Reduced demand for crude oil means more stability in India’s energy bills and less exposure to global oil price shocks.

Biofuel integration alters the demand for base oils, additives, and fuel-compatible lubricants.

Diversification into alternative energy sources reshapes the industrial landscape, creating demand for specialized lubricants in solar, wind, and EV sectors.

This evolving energy matrix means lubricant manufacturers must keep pace with new fuel types, new engines, and sustainability mandates.

Implications for Lubricant Makers

Market Outlook

India’s industrial lubricant market is valued at approximately US$7.25 billion in 2024 and is projected to reach US$9.22 billion by 2030, with a CAGR of around 4.3%. Growth is driven by construction, automotive, mining, and power generation. However, biofuel adoption will transform the way lubricants are formulated, marketed, and regulated.

Shift Toward Sustainable Lubricants

Eco-friendly Solutions: With biofuels gaining traction, there is rising demand for biodegradable and low-toxicity lubricants that reduce environmental impact.

Synthetic Lubricants: These offer higher performance, lower emissions, and compatibility with modern engines that run on ethanol-blended fuels.

Bio-based Lubricants: Derived from vegetable oils, they align with India’s broader clean energy transition.

Extended Producer Responsibility (EPR)

From April 2024, India extended EPR obligations to used oils, requiring lubricant makers to collect and recycle a percentage of the oil they sell.

Initial target: 5% collection in 2024–25.

Rising gradually to 50% by 2030–31.

Although India has nearly 1 million tons of rerefining capacity, actual output in 2022 was only 27 kilotons, showing massive room for growth.

This means lubricant manufacturers must invest in collection networks, recycling partnerships, and circular business models to remain compliant and competitive.

Innovation and Customization

EV Lubricants: As electric mobility expands, demand for specialized coolants, greases, and thermal management fluids will grow.

Industrial Solutions: Heavy machinery, mining, and manufacturing sectors require lubricants that perform under extreme conditions while meeting sustainability norms.

Digital Lubrication: IoT-enabled monitoring and predictive maintenance are revolutionizing how lubricants are used and serviced.

Key Challenges

Raw Material Volatility: Fluctuating crude oil prices impact base oil and additive costs.

Technical Awareness Gap: Many end-users lack knowledge of advanced lubricants, slowing adoption.

Regulatory Pressure: Stricter environmental norms require continuous R&D investment.

For lubricant makers, adapting to this dynamic environment is not optional—it is essential for survival and growth.

The Role of RBM Oil Corporation

RBM Oil Corporation, established in 2016 and headquartered in Pune, Maharashtra, has positioned itself as a leading manufacturer, exporter, importer, retailer, and trader of base oils, automotive lubricants, industrial oils, and greases. The company’s diverse portfolio includes:

Engine oils (e.g., Gusto 15W40).

Hydraulic oils (e.g., EP68).

Specialty greases and gear oils.

How RBM Connects with India’s Energy Transition

Eco-Friendly Expansion: As India moves towards renewable energy, RBM has the opportunity to expand into bio-based and biodegradable lubricants, aligning with the nation’s sustainability goals.

EPR Readiness: With used-oil recycling mandates in place, RBM can build collection partnerships to reinforce its green credentials.

Strategic Location: Being based in Maharashtra—one of India’s industrial hubs—positions RBM to cater to high-growth markets across automotive, manufacturing, and power sectors.

Innovation Potential: By investing in R&D for advanced formulations, RBM can strengthen its brand as a forward-looking, customer-centric lubricant provider.

Future Outlook and Conclusion

India’s biofuel and energy diversification journey is more than just a policy—it is a paradigm shift. For the lubricant industry, it signals a future where:

Bio-based and synthetic lubricants will dominate.

Circularity through EPR will become standard practice.

Digital and smart lubrication solutions will be the norm.

Customer education will play a vital role in adoption.

Lubricant makers who embrace this transformation will not only stay competitive but also become key enablers of India’s sustainable industrial growth.

For companies like RBM Oil Corporation, this is the perfect moment to innovate, diversify, and reinforce their commitment to quality and sustainability. As India accelerates its clean energy transition, lubricant makers have a golden opportunity to grow alongside the nation’s progress.