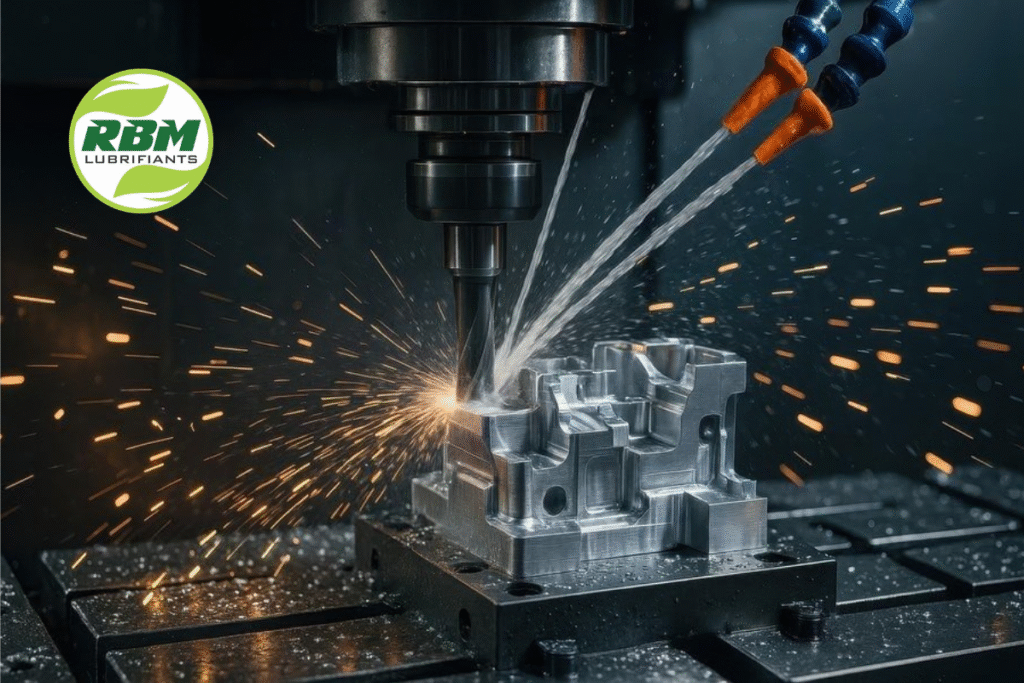

In modern machining, productivity is no longer driven only by machine speed or tool quality. One often-overlooked factor plays a major role in tool life, surface finish, power consumption, and production cost cutting oil.

Whether you’re running a CNC machine, VMC, lathe, or drilling operation, the right high-performance cutting oil can significantly improve performance while reducing wear, downtime, and energy usage.

Let’s explore how cutting oil works, why it matters, and how choosing the right one can transform your machining operations.

What Is Cutting Oil and Why Is It Essential in Machining?

Cutting oil is a metalworking fluid designed to lubricate and cool the cutting zone where the tool meets the workpiece. This area experiences extreme pressure, high temperatures, and intense friction.

Without proper lubrication:

- Tools wear out faster

- Heat damages the surface finish

- Machines consume more power

- Scrap rates increase

A high-quality cutting oil forms a protective lubricating film, reducing metal-to-metal contact and controlling heat generation during machining.

How Cutting Oil Improves Tool Life

One of the biggest benefits of using premium cutting oil is extended tool life.

Key Ways Cutting Oil Protects Tools

- Reduces friction at the cutting edge

- Prevents built-up edge (BUE) formation

- Minimizes micro-welding between the tool and the metal

- Protects against corrosion and oxidation

With less friction and heat, tools maintain their sharpness longer—resulting in fewer tool changes and lower tooling costs.

Cutting Oil’s Role in Better Surface Finish

Surface finish is directly affected by temperature stability and lubrication quality.

High-quality cutting oils:

- Ensure smooth chip flow

- Prevent chatter and vibration

- Reduce scoring and tearing of metal

This results in cleaner finishes, tighter tolerances, and reduced post-machining operations, such as polishing or rework.

What About Grease Production?

ENEOS also makes grease at the Yokohama plant — used in industrial machinery, automotive parts, and construction equipment. The company has not yet confirmed whether grease production will also stop, but it is under review.

How Cutting Oil Reduces Power Consumption in CNC Machines

Friction doesn’t just wear tools—it consumes energy.

Poor-quality or incorrect cutting oil increases resistance at the cutting zone, forcing machine spindles and motors to draw more power.

Energy-Saving Benefits of the Right Cutting Oil

- Lower spindle load

- Reduced motor amperage

- Smoother cutting action

- Stable machining parameters

Even a small reduction in spindle load can lead to noticeable electricity savings, especially in high-volume production environments.

The Importance of Additives in Cutting Oil

Not all cutting oils perform the same. The difference lies in the additive package.

Essential Additives in High-Performance Cutting Oils

- Extreme Pressure (EP) Additives – Protect tools under heavy loads

- Anti-Wear Agents – Reduce tool and machine wear

- Friction Modifiers – Improve cutting efficiency

- Anti-Oxidants – Extend oil life and stability

These additives enable cutting oils to perform reliably under high speeds, high pressures, and elevated temperatures.

Neat Cutting Oil vs Soluble Cutting Oil: Which Should You Choose?

Neat Cutting Oil

- Used without water

- Excellent lubrication

- Ideal for heavy-duty machining, threading, and broaching

Soluble Cutting Oil

- Mixed with water

- Superior cooling

- Suitable for general machining, milling, and drilling

Choosing the right type depends on material, machining process, and operating conditions.

Common Problems Caused by Poor Cutting Oil Selection

Using the wrong cutting oil can lead to:

- Excessive tool wear

- Smoke and odor issues

- Poor surface finish

- Higher scrap rates

- Increased power consumption

Many machining problems are often incorrectly attributed to tools or machines when the real issue is actually improper lubrication.

Long-Term Cost Benefits of Using Premium Cutting Oil

While premium cutting oils may cost more upfront, they deliver significant long-term savings:

- Longer tool life

- Reduced machine downtime

- Lower electricity consumption

- Improved productivity

- Consistent machining quality

Over time, this leads to lower cost per component and higher overall efficiency.

Conclusion:

Cutting Oil Is a Performance Multiplier, Not Just a Lubricant

Cutting oil is more than just a coolant—it’s a critical performance factor in machining operations.

The right cutting oil:

- Extends tool life

- Improves surface finish

- Reduces energy consumption

- Lowers production costs

At RBM Oil Corporation, our cutting oils are engineered to deliver high lubrication efficiency, thermal stability, and consistent performance, helping manufacturers achieve maximum productivity with minimum waste.

Looking to optimize your machining operations?

Explore RBM’s range of high-performance cutting oils designed for CNC, VMC, lathe, and heavy-duty metalworking applications.