Introduction

In today’s fast-changing world of automobiles and industries, the choice of lubricants is no longer a simple matter of cost.

With growing environmental concerns, rising fuel efficiency demands, and stricter emission norms, businesses and consumers are asking: “Which lubricant is better for the future—synthetic or mineral oils?”

As we move through 2025, this debate has become more relevant than ever. Synthetic lubricants are engineered for performance and sustainability, while mineral oils have long been trusted for their affordability and availability. But with industries moving towards eco-friendly and high-performance solutions, one question dominates the market: Will synthetic oils replace mineral oils as the new standard?

What Are Mineral Oils?

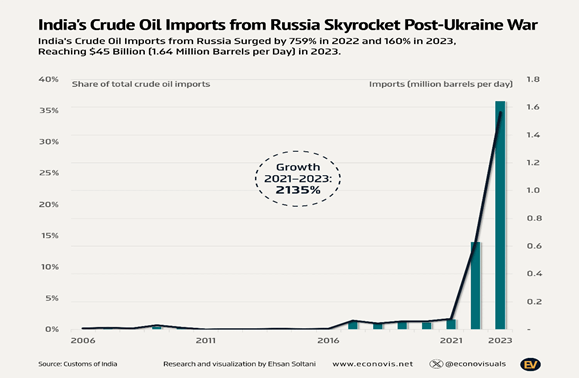

Mineral oils are the most traditional type of lubricants. They are derived from refined crude oil and have been the backbone of the automotive and industrial sectors for decades.

Key Features of Mineral Oils:

- Affordable: Their biggest advantage is lower cost, making them popular among price-conscious markets.

- Widely available: Produced in bulk from crude oil, they are accessible worldwide.

- Good lubrication: Provide decent wear protection for engines and machines.

Limitations:

- Shorter lifespan compared to synthetics.

- Prone to oxidation and sludge formation.

- Break down at high temperatures.

- More frequent oil changes needed.

Mineral oils still hold a large market share in developing economies where cost is a primary factor. However, their performance limitations are being exposed as industries demand more efficiency.

What Are Synthetic Oils?

Synthetic lubricants are man-made oils produced through chemical engineering. Instead of being simply refined from crude oil, they are scientifically designed to deliver superior performance in extreme conditions.

Types of Synthetic Oils:

- PAO (Polyalphaolefin): Excellent stability, used in automotive and industrial oils.

- Esters: Provide high lubricity and are often used in aviation.

- Synthetic blends: A mix of mineral and synthetic oils, balancing cost and performance.

Key Benefits of Synthetic Oils:

- High thermal stability: Resist breakdown at high and low temperatures.

- Longer drain intervals: Reduce the frequency of oil changes, saving time and cost in the long run.

- Better wear protection: Extend the life of engines and machinery.

- Fuel efficiency: Reduce friction, improving mileage and energy efficiency.

- Eco-friendly: Lower emissions and align better with sustainability goals.

In short, synthetics are not just lubricants; they are performance enhancers.

Synthetic vs. Mineral Oils: A Head-to-Head Comparison

| FEATURE | MINERAL OIL | SYNTHETIC OIL |

| Cost | Affordable upfront | Higher upfront cost, long-term savings |

| Performance | Adequate for basic needs | Superior performance in all conditions |

| Durability | Requires frequent changes | Long drain intervals |

| Temperature range | Limited stability | Performs in extreme hot/cold conditions |

| Environmental impact | Higher emissions, sludge formation | Cleaner, greener, lower emissions |

| Applications | Conventional vehicles, low-demand machinery | High-performance engines, EVs, heavy-duty equipment |

2025 Market Trends in Lubricants

The global lubricant market is undergoing a major transformation:

Shift Towards Synthetic and Bio-Based Oils:

By 2025, synthetic lubricants are expected to grow at double the rate of mineral oils, thanks to consumer awareness, industrial demand, and sustainability mandates.

Industrial Growth:

Manufacturing, construction, and mining sectors are demanding high-performance lubricants that reduce downtime and extend machinery life.

Automotive Evolution:

With the rise of electric vehicles (EVs), the demand for specialized fluids (thermal management fluids, coolants, greases) is skyrocketing. Mineral oils cannot meet these requirements.

Regulatory Pressure:

Governments are imposing stricter environmental and recycling laws. From 2024, India introduced Extended Producer Responsibility (EPR) for used oils, requiring companies to recycle and reduce environmental impact. This is pushing the market towards synthetics and eco-friendly alternatives.

Consumer Awareness:

Vehicle owners are realizing that while synthetic oils are costlier upfront, they save money in the long run by extending engine life and reducing fuel consumption.

Simply put, synthetics are the future of lubricants, while mineral oils will slowly lose relevance in premium and industrial segments.

What It Means for Businesses and Consumers

For Industrial Buyers

Efficiency: Synthetics reduce friction and improve machinery performance.

Cost Saving: Though expensive initially, they save money by extending maintenance cycles.

Sustainability: Meet corporate ESG goals and government norms.

For Automotive Users

Better Protection: Keeps engines cleaner, runs smoother.

Fuel Economy: Reduces fuel consumption in both petrol and diesel engines.

Longer Oil Life: Fewer oil changes = lower maintenance cost.

For Lubricant Manufacturers

The shift demands continuous innovation in formulations.

Companies must invest in bio-based, biodegradable lubricants.

Partnerships for used oil collection and rerefining are now a necessity.

RBM Oil Corporation’s Perspective

As India experiences this transformation, RBM Oil Corporation, headquartered in Pune, Maharashtra, is at the forefront of supplying reliable, high-quality lubricants. Since its inception in 2016, RBM has built a strong reputation as a manufacturer, exporter, importer, and trader of:

- Engine Oils (Gusto 15W40 and more).

- Hydraulic Oils (EP series).

- Cutting Oils and Process Oils.

- Industrial Greases and Specialty Oils.

Aligning with the Future

RBM is well-positioned to expand its portfolio in synthetic and bio-based lubricants, helping industries transition smoothly.

With India’s EPR norms, RBM can become a leader in oil recycling and circular practices.

Its strategic location in Maharashtra—an industrial hub—gives it an edge in catering to automotive, construction, and manufacturing sectors.

RBM’s commitment to quality, performance, and sustainability ensures it remains relevant in the synthetic-dominated future of lubricants.

Conclusion

The debate of synthetic vs. mineral oils is tilting strongly in favor of synthetics in 2025. While mineral oils will still find a place in cost-sensitive markets and older machinery, the future belongs to synthetic and bio-based lubricants.

Synthetic oils offer unmatched performance, efficiency, and sustainability.

Mineral oils will gradually decline as industries and consumers demand higher standards.

Lubricant makers must embrace innovation, sustainability, and recycling to remain competitive.

For businesses like RBM Oil Corporation, this is not just a challenge but a golden opportunity to lead the change. By focusing on synthetic and eco-friendly lubricants, RBM and similar companies can play a pivotal role in shaping the future of India’s lubricant industry.

In 2025 and beyond, synthetic lubricants will dominate—driving performance, efficiency, and sustainability in every sector.